The stimulus is buying artificial

economic life and bubbles of asset class waiting to create more stimuli. The

year 2021 is not the year of Equities or commodity neither currency. The year

2021 is the year of stimulus and negative yields with cheese of corporate

defaults. Well, nothing to get scared we have Space Shuttle of Money ready in 2021. During GFC and post-GFC we have seen

Helicopter money and now in this pandemic, we have seen the same Helicopter

money. In the year of 2021 we will not see helicopter money but “Space Shuttle of Money”. What we got as the stimulus in 2020 is

going to be repeated in 2021 and maybe more.

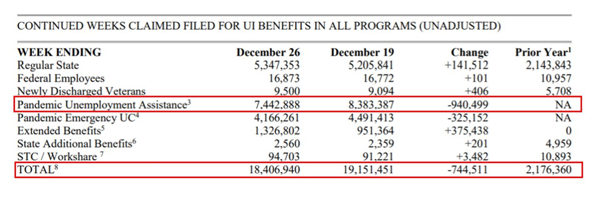

We are here to find out the demand creators of the stimulus in 2021. Yes, the analytical part of the data which we will be discussing will lead to evolving the stimulus demand creators in 2021. From here only we will get an idea of how much helicopter money is going to come from key countries to get the whole sketch completed. We are trying to find how many sectors, companies will be the demand creators of bailout and stimulus money and money to manage corporate defaults in the bond market. We are here to find how long the stimulus will go on.

Central banks are out of ammunition of reducing

interest rates and globally there is little scope of interest rate to come

down. The accommodative stance is the most common word for the central bankers

in 2021. Truly speaking the power of monetary policy has moved long back from

the central banks to the Government and hence they are the decider of the

stimulus money. If we look at the utilization level of the stimulus money it’s

well clear that we are just keeping the corporate in Ventilator and just buying

the electrical equipment facility by keeping the companies to breathe.

Now lest get deep into the U.S banks to judge their pockets and how much doubtful debt they have, however, many banks have under-provisioned for what is likely to be a tougher 2021 environment than expected.

The data above speaks very well that to bail out banks more stimulus will be coming and the US will have negligible space to go ahead with the massive rollback of any stimulus or interest rates etc for till 2023. Most consensus estimates assume banks will publish exceptional earnings growth mainly due to lower provisions as the economy recovers. There is more pain left for the US and for the global economy in 2021 where it is found that debt bubbles and defaults will demand more stimuli.

In recent research, it has been found that around 527 of the companies in the Russell 3000 index of large U.S. corporations, with a combined $1.36 trillion of debt, are “zombies” — meaning they had trailing 12-month operating income that fell short of the interest expenses they owed over the same period. After all, companies that don’t even make enough to cover their obligations aren’t in much of a position to hire more workers or invest in opportunities to grow their businesses.

So summing

up stimulus money will keep flowing in 2021 and 2022 as long as the defaults

are not covered enough and the demand creators. The recent $1.9 trillion is

going to fall short and we will need more of the same. Japan lockdown brings

more stimuli in future dates and the same is applicable for Europe and UK

followed with all those countries where the chain of defaults is at-risk

level. The stimulus under the disguise of vaccination is more to buy

defaults and unemployment. Vaccination is big business and many ancillary

sectors are dependent on the same. Money breeds money. The Sudden surge in

Bitcoin reflects easy money can buy anything when you don’t know where to

spend. But the reality is that income inequality has widened enough and this

stimulus will have a long way to go.

Well as long as employment does not get backs to a normal stimulus will keep floating. In simple terms as long as the young generation does not get a job. Well, when the U.S. has over $1.3 trillion dollars in student loan debt a few trillion will be given to keep the job market alive artificially.

0 Comments:

Post a Comment