Post this discussion paper we will find many NBFC looking for exiting the business and we will witness a sudden spike in M&A in coming days. This is the nature of the business when laws become stringent. The capital market will also witness some knee jerk reaction and less focus on allocation in the long term until the M&A and take over provides clarity to the industry. The discussion paper will sound to be a bullet for the ones who cannot cope up with the same in the long term. The rules of classification and how they are controlled will spike the M&A in the industry.

The much long waited and finally, it comes in the form of discussion

papers and will become law one fine morning for the betterment of the Indian

financial system. NBFC plays a big role in

every class of the society and particularly for the deposit makers who risk

with their life savings. NBFC sectors come under stringent guidelines

which will only now lead to more rules and guidelines to strengthen and provide

protection to the investors where the NBFC is deposit-taking one. We have seen

DHFL and how people burnt their fingers and particularly the senior citizens

when they get into a fiasco. The suffering of the common man never ends- his/her own

money is often begged in front of judicial administration. DHFL, Reliance Capital, and the latest, Altico

are the lesson providers for the NBFC failure in India. Post

pandemic we cannot afford to have any major crisis like DHFL etc. The new discussion paper is just the

begging of a new era for the NBFC sector where investors will be protected in

the long term. The discussion paper for NBFCs, proposes tighter norms,

multilayer structure.

One

of the critical areas where the focus has been built in this discussion paper

is that NBFCs and urban cooperative banks(UCBs) will have to submit a

risk-based internal audit and a harmonised guidelines for appointing statutory

auditors for commercial banks, UCBs and NBFCs with a view to improving the

quality of financial reporting. This reporting framework has been misused

and misguided often in many of the cases where the NBFC went for a toss.

Its flaw in the system and misuse of the auditing standards which have

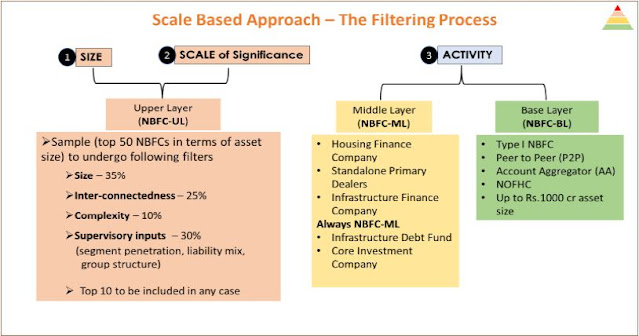

been pointed in every NBFC failure cases. The discussion paper speaks that 9,209 out of 9,425 non-deposit taking NBFCs with the

least regulatory intervention consisting of non-systematically important NBFCs,

Peer to Peer lending platforms, Account Aggregators, Non-operating Financial

Holding Company (NOFHC) will come under NBFC BL. All NBFCs with asset size of ₹1,000

crores will fall under the NBFC- BL category.

In this discussion paper, NBFC has been classified under different layers. The discussion paper has said, the regulatory framework of NBFCs shall be based on a four-layered structure– base layer (NBFC-BL), middle layer (NBFC-ML), upper Layer (NBFC-UL), and top layer. Every level has its own classification and rules guiding the same.

Every layer of the NBFC definition as discussed in the discussion papers highlights many things on which different category of NBFC ( defined under the discussion paper) is classified as a certain category of NBFCs cannot provide loans to companies for buy-back of shares/securities. IPO financing by NBFCs will be subject to a ceiling of Rs 1 crore per individual for any NBFC. Further, a sub-limit within the commercial real estate exposure ceiling should be fixed internally for financing the land acquisition. Even NPA classification norms NPA classification norm of 180 days will be brought down to 90 days for a certain category of NBFC. Further in NBFC classification, the concept of Core Equity Tier-1 is being introduced based on the calssification.

RBI has raised the entry-level net

owned funds requirement for these NBFCs to ₹20 crores

from ₹2 crores earlier and also

proposed that the exiting NBFCs can transition to the new regulation over a

period of 5 years. Hence this vertical is no longer going to be an

easy catch. The biggest risk of the current pandemic is the NBFCs operating

through an online model where the retail loan is at risk and the depositor’s

money is equally at more risk.

In a recent study, it was found that delinquent accounts for India’s fintech lenders nearly doubled between August 2019 and August 2020 as they disbursed loans to high-risk customers. NBFC crisis is not known-from bondholders to equity holders all have burnt their fingers. The senior citizens are the worst affected. These discussion papers are the beginning steps of making Indian financial economy into a stronger footprint.

0 Comments:

Post a Comment