SEBI has come up with a consultation paper on AIF commission payment where the current form of upfront will be abolished and the same will be in trail format. The impact of this change will be significantly high on the wealth Industry. A further direct plan will be introduced in AIF so as to make level playing. Well has asked for these direct plans and also who is demanding a level playing field. The private equity investment segment which has invested significantly behind the wealth firms should raise its voice and should dig deep to change the ideology that rather than compromising on earnings it’s better to focus on the key segment of so-called miss-selling. Miss-selling cannot be abolished by tweaking revenue-earning structures. We don’t disagree that miss selling did not happen and wealth butchers were not flocking on the street shopping clients mercilessly. The wealth Industry will find significant setbacks from this new set of laws under Consultation from SEBI. We won’t be surprised if we find a significant M&A in the wealth industry and a consolidation.

My 1st question is what this level playing

field means. Does this means that make it a similar product to a mutual

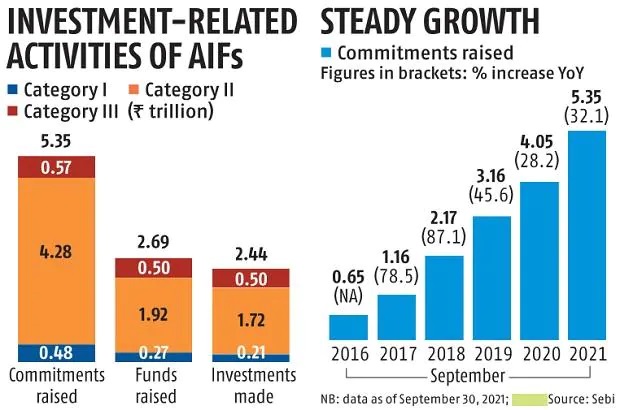

fund? The industry size of AIF Category

3 is just only around Rs.80000 cr hence it has a long way to go ahead to become a

significant product in India. The change

of structure from upfront to trail will not only impact the margins of the

business but the immediate impact will be on the valuations of these companies,

their long-term survival, and most importantly on jobs. The upcoming valuation of all these listed and

unlisted wealth firms will get a significant setback impacting massive layoffs

to manage the valuations and profitability.

Why the Regulators or

Ministry of finance did not take any actions when HDFC Sanchay-type products were

being sold where the commission was still around 45% to 55%. If the question of level playing needs to

come up then it should be across all products and not specific to any one category but here the level playing is with the Mutual Fund product.

On one side we raise voices on entrepreneurship and the creation of Jobs

and employment and on the other hand, we are killing the growth of an upcoming

industry that is at its nascent stage. Earning

plays a pivotal role in every business and it is observed that the

finance industry is being demotivated simply by downgrading the earning

structures and at the same time bringing down the growth of the industry.

Mutual funds are still miss sold and the same with Insurance. If we look at the volume of complaints of the

various grievance cell of these product-related governing bodies we get much

more clarity. When a miss sold case is investigated and found to be valid then how

many of these Banks and Financial Institutions have been banned from an operation or

levied with huge charges. Well we only

know instances like Karvy and ILF&S but nothing prior to these has been

much penalized where a lesson could be given or a factor of fear of wrongdoing

imposed.

When the last time was that the Mutual fund expense ratio was reduced? Well, check the dates you will find that

from 2015 to 2018 the battle went and got the expense ratio was reduced so as

the earnings and post that within the next 2 to 3 years many AMC got listed. Valuations and listing gains, ESOP encashment at the cost of level playing, and miss-selling. Now

this AIF is facing competition from Mutual Funds hence the factor of level

playing comes up significantly. Now post brokerage in AIF being paid in trail AIF will lose its glory and Mutual Funds AUM will grow significantly since the

level playing factor will come into play. Most of

Mutual Fund's key Industry leaders don’t have AIF and PMS hence the business faces

significant challenges from these AIF manufacturers. In the coming days, we will find huge churning

in Mutual Funds and more inflows into the same.

Don’t be surprised if you find the Mutual Fund Industry to get another

million in the next 5 years' time frame.

The size of the AIF industry in other countries will draw your ears. We will take you to the pre-covid numbers of the EU where it is being found AIF market reached USD 10.3 Tn in 2019 in the US (vis-à-vis USD 23.5 Bn in India. AIF investments were valued at USD 7.0 Tn at the beginning of 2019. The market grew 11% from the previous year, mainly following the launch of new AIFs in 2018.

The numbers are enough to speak about the opportunity India could have and will now have post-revision of the structures. Rather than attacking the earnings of the product, the regulator should have focused on the age limit, making limits and restrictions of HNI and Ultra HNI investors and also making different structures for institutional investors to invest in CAT III. Well, the game is played by the same players who played before getting listed to reduce the expense ratio of MF. Post April 2023 many wealth firms and their employees will face hard times if the AIF structure upfront is changed.

0 Comments:

Post a Comment